Klima-, Energi- og Bygningsudvalget 2012-13

KEB Alm.del Bilag 218

Offentligt

NordicEnvironmentFinanceCorporationAnnualReview2012

nefco 2012

1

Contents

NEFCO 2012

NEFCO inbrief

••3468911121416192021242829303234•

Case study I: Russia, Wastewater treatmentHighlights of the yearNEFCO in briefInterview with Magnus RystedtEnergy investmentsCase study II: Russia, A cleaner future for Lake OnegaWorking for a healthier Baltic SeaCase Study III: Lithuania/Latvia, Treatment of contaminated soilMitigating environmental toxinsEnvironmental initiatives in the ArcticEnvironmental status reportExamples of emission reductions in 2012Case Study IV: Ukraine, Lighting up ZhytomyrReport of the Board of DirectorsFinancial statementIndependent Auditors’ ReportStatement by the Control CommitteeApproved projectsCase study V: Ukraine, Fair winds for UkraineFive year comparisonPersonnel 2012

The Nordic Environment Finance Corpora-tion (NEFCO) is an international financialinstitution, which was established in 1990NEFCO’s primary purpose is to financecost-effective environmental projects in thesinki, Finland.neighbouring regions of Eastern Europe.by the five Nordic countries: Denmark,

loans to businesses and municipalities thatinvest in environmental projects in thethe corporation may invest share capital intries mentioned above.regions in which it operates. In some casesbusinesses that have projects in the coun-tion relies on local consultants to identifyIn St. Petersburg and Kiev, the corpora-

NEFCO offers loans and subordinated

Finland, Iceland, Norway, and Sweden.

The Corporation’s headquarters are in Hel-funds aimed at financing environmentalCurrently, NEFCO manages a number of

new partners and investors in Russia andvironmental criteria and offer quantifiablereductions in emissions are eligible for

Ukraine. Only projects that satisfy strict en-NEFCO’s financing. NEFCO’s Board of Di-decision on all investments.

projects in Russia, Ukraine, Belarus andMoldova as well as, for a limited period, inEstonia, Latvia and Lithuania. The corpora-tion has also launched environmental pilotprogrammes in China and Peru. NEFCOis heavily engaged in climate financingand the Corporation's carbon fund NeCFthe world.purchases emission reduction units acrossducing environmentally harmful emis-sions, such as greenhouse gases, toxic pol-lutants and nutrients fuelling eutrophica-tion in the Baltic Sea.NEFCO finances projects aimed at re-

NEFCO’s pri-mary purposeis to financecost-effectiveenvironmentalprojects in theneighbouringregions ofEastern Europe.

rectors, which comprises members fromeach of the Nordic countries, gives the final

2

nefco 2012

nefco 2012

3

Highlightsof the year2012

JaNuaryThe Third Call for Proposalsfor the Nordic Climate Facility(NCF) generated altogethersome 130 applications.—NEFCO and Vitebsk MeatPacking Plant signed a loanagreement for the moderni-sation of meat productionfacilities in Vitebsk, Belarus.FEbruaryNEFCO joins a fact-findingmission to Kingisepp, Russia,to gather information on thehigh nutrient load found inthe River Luga.—The Operational Review ofNEFCO’s Carbon Financeand Funds for 2011 showedthat NEFCO managed toacquire over 2.3 millioncarbon credits for its inves-tors during the period.MarChAccording to the financialaccounts for 2011, NEFCOapproved 66 new projectsduring the year.

aprilNEFCO and the municipalityof Kingisepp in NorthwestRussia signed a Memoran-dum of Understanding tofinance the modernisation ofKingisepp’s water distribu-tion and wastewater treat-ment facilities.MayNEFCO and the watercompany OKOS signed aloan agreement to rehabili-tate wastewater treatmentfacilities serving the townsof Svetlogorsk, Pionersk andZelenogradsk in Russia. Theproject is also financed bythe EU.—NEFCO, together withFinnfund and Nordea Bank,signed a loan agreement tofinance the construction ofMyllyn Paras’ new millingand cereal production facili-ties in Russia.JuNEThe U.S. governmentdecided to allocate funds tothe Arctic Council’s ProjectSupport Instrument (PSI),which is administered byNEFCO.—NEFCO’s Board of Directorsdecided to boost financialsupport for municipalenergy efficiency measuresby raising the maximumloan amount per projectfrom EUR 260,000 toEUR 400,000.JulyThe Finnish and Russiangovernments, together withthe Petrozavodsk Commu-nal Utilities Systems and agroup of international finan-cial institutions, signed an

investment package aimedat improving drinking waterquality and the wastewatertreatment facilities in Petro-zavodsk, Russia. NEFCOprovides a EUR 4 million loanfor the project.—NEFCO assumed the chair-manship of the Steeringgroup of the Eastern EuropeEnergy Efficiency and Envi-ronment Partnership (E5P).augustNEFCO signed loan agree-ments to finance municipalenergy efficiency measuresin the Ukrainian cities ofBerezan and Zhytomyr.sEptEMbErNEFCO signed a Memo-randum of Understanding(MoU) with the PeruvianMinistry of Environment tocover technical cooperationin the solid waste sectorunder the Nordic PartnershipInitiative.OCtObErNEFCO hosted an interna-tional expert event on theemerging climate financeinstruments, the so-calledNationally Appropriate Miti-gation Actions (NAMAs).NOvEMbErNEFCO’s Carbon Financeand Funds Unit signed anEmission Reductions Pur-chase Agreement with CFPEnergy Limited to obtainemission reductions from awind power project in Kret-inga, Lithuania.dECEMbErNEFCO decided to expandits area of operation toMoldova.PATRIK RASTENBERgER

CasE study

I

RussiaWastewatertreatment

01

NEFCO, together withFinnfund and NordeaBank, signed a loanagreement to financethe construction of Myl-lyn Paras’ new millingand cereal productionfacilities in Russia.

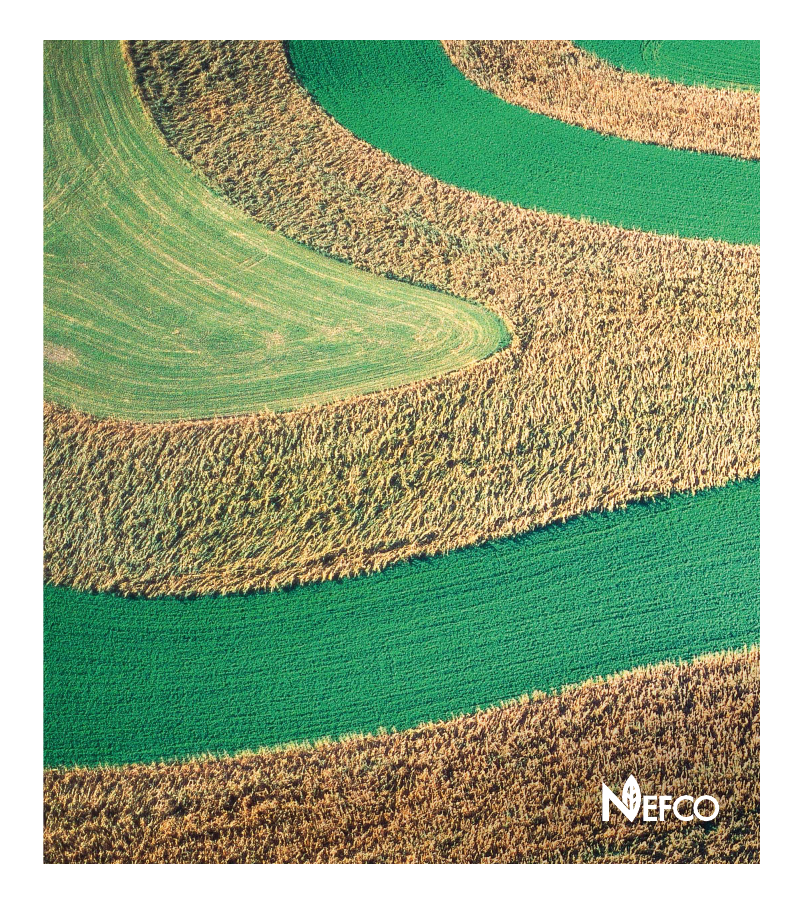

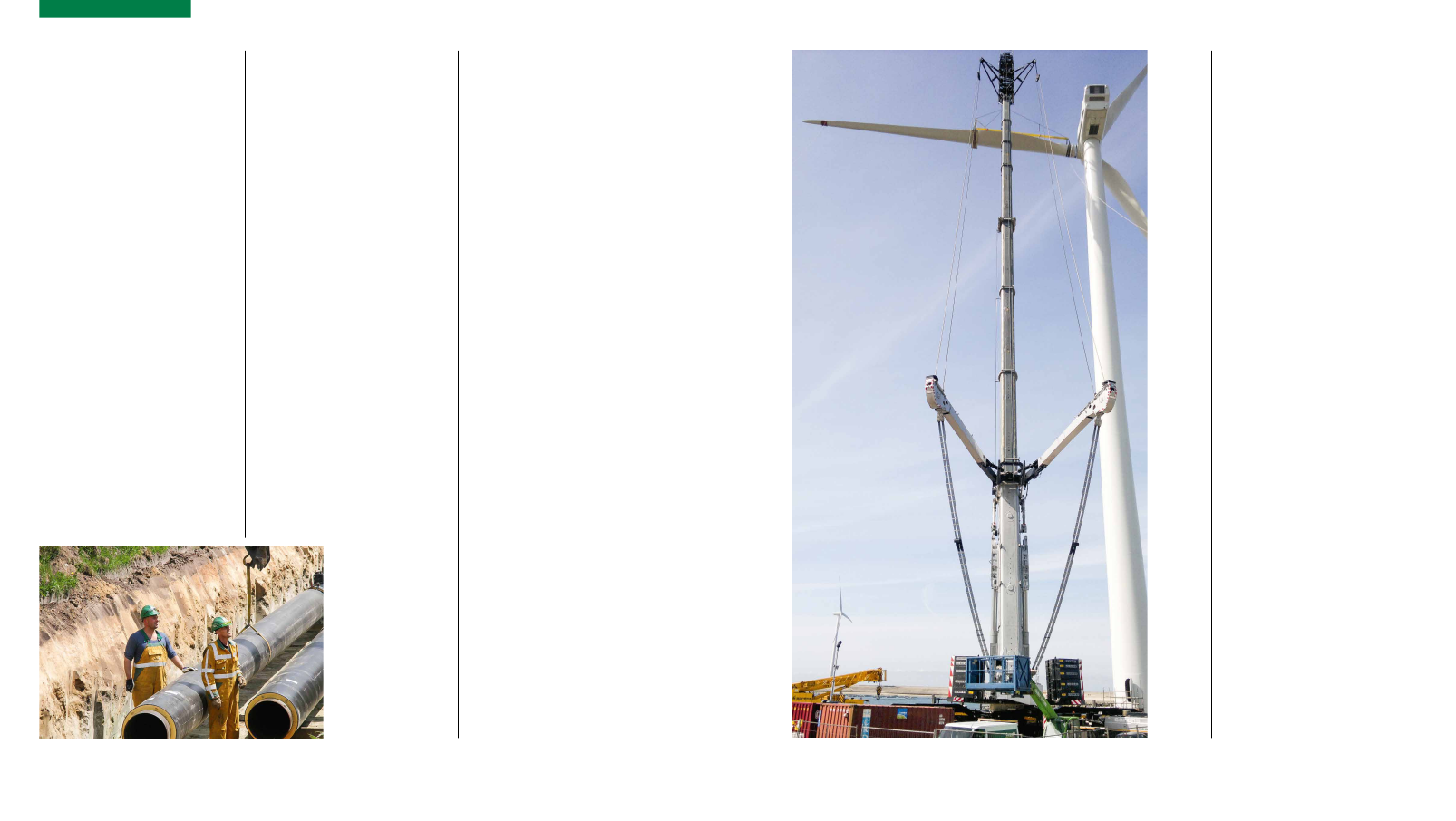

The sea front at Svetl-ogorsk. In May 2012, NEFCOsigned a loan agreementwith the water companyOKOS to rehabilitatewastewater treatmentfacilities serving the townsof Svetlogorsk, Pionerskand Zelenogradsk in theKaliningrad region of Rus-sia. The project will reducephosphorus dischargesby around 13 tonnes peryear, which is equivalentto unprocessed dischargesfrom a population of some18,000 persons. The projectis also financed by the EU.

01

VALERy gORCHAKOV

4

nefco 2012

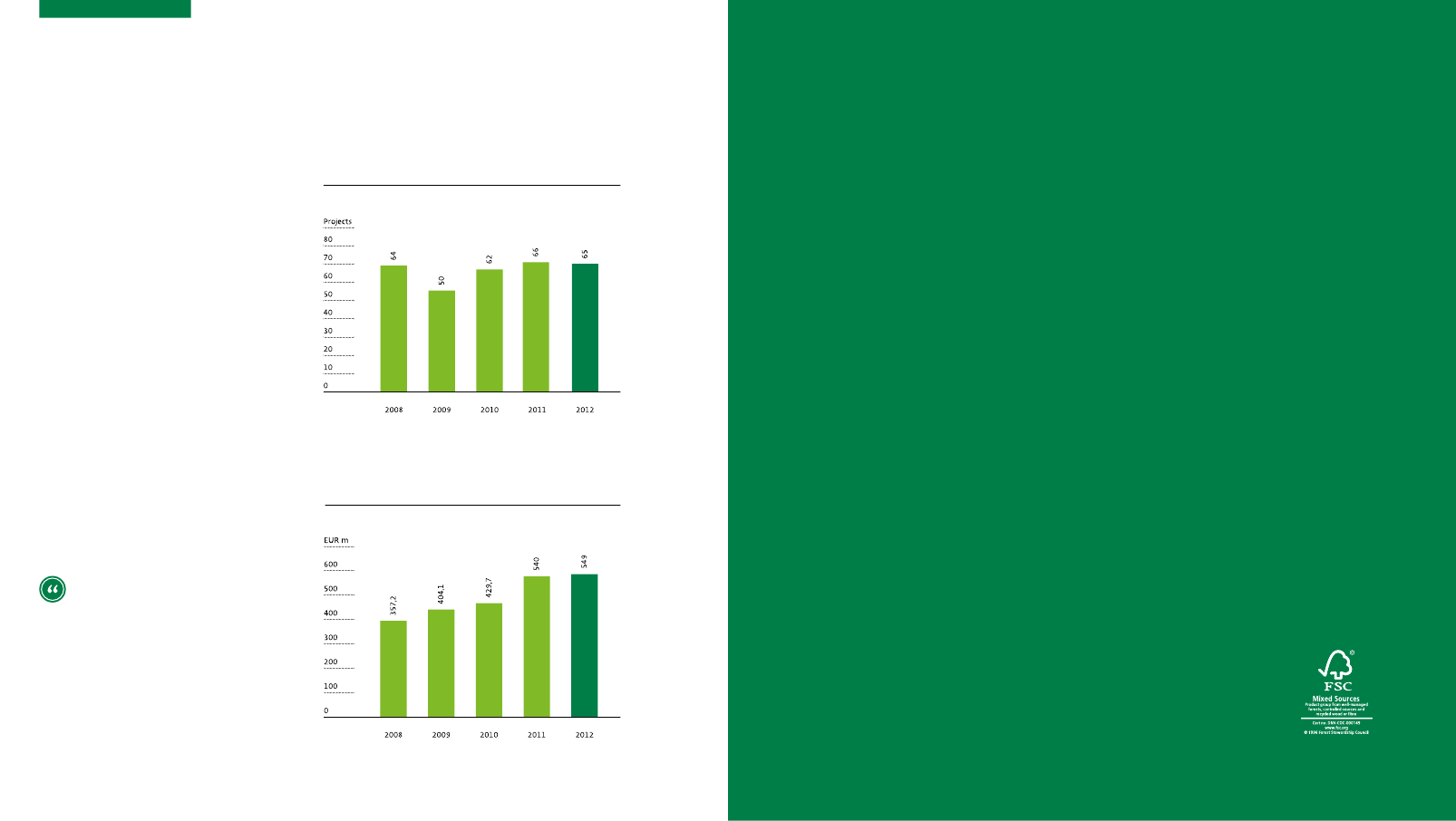

Can you describe NEFCO’s competitiveadvantages in a few words?NEFCO is an international financial in-stitution specialised in financing projectsfinancing for cost-effective green projectsNEFCO's MaNagiNg dirECtOrimplemented by Nordic companies andwith environmental benefits. We can offerlocal stakeholders in countries in whichwe operate. As an international financialments, we are a solid financing partner andinstitution owned by the Nordic govern-our profound expertise in environmental,financial and legal issues is a true com-petitive advantage and asset to our clients.how would you like to describe NEFCO’sperformance in 2012?Despite the economic downturn in Eu-rope, we were able to maintain a steadyflow of new projects. A total of 65 new pro-jects were approved and administered byall the funds managed by the corporationachieve good environmental results. Formillion tonnes – a figure correspondinginstance, our climate investments in 2012reduced carbon dioxide emissions by 3.6to the amount of carbon dioxide emittedwhen 11.7 million passengers travel bylast year, NEFCO decided to expand itsarea of operation to Moldova. Why?We decided to follow the Eastern EuropeEnergy Efficiency and Environment Part-ated in Ukraine since 2011 and NEFCO hasnership’s (E5P) example to broaden thegeographic scope to Moldova. E5P has oper-chaired the Steering Group of E5P since Julyaeroplane from Helsinki to Paris and back.was EUR 549 million. We also managed toNEFCO during the period, and the value of

the financial situation in NEFCO’s maincountries of operation is currently chal-lenging. how will this affect NEFCO’sbusiness operations in 2013?In the wake of the global economic slow-down and continued financial crisis in Eu-not been unaffected. NEFCO acknowledgestionary measures to maintain a healthytant for an organisation such as NEFCOrope, NEFCO’s countries of operation havethe elevated risk and it will take precau-portfolio rather than reducing the effortsin the countries concerned. It is impor-to continue its operations even in times ofstress, as its presence becomes even moreimportant when other sources of financ-ing become scarce. Not only does NEFCO’smaintained presence strengthen the rela-also provide NEFCO with future advantageswhen the economies stabilise.What is the outlook for NEFCO’sactivities this year?We foresee a robust flow of new projectsin the E5P. In the Arctic region, we hopeto be able to finance a range of new en-backing from the Arctic Council’s memberin Ukraine as a result of our involvementvironmental projects, given the financialcountries and the Project Support Instru-ment administered by us. The pilot pro-ready taking place. Moreover, we will try towith commercial banks in our countriesgramme in Peru will also move ahead asthe project preparation on the ground is al-explore new innovative ways to cooperateof operation, and, last but not least, we areexpecting a decision on the replenishmentopment Fund in 2013.of NEFCO’s Nordic Environmental Devel-tions with its current partners but it will01

Interviewwith MagnusRystedt

It is important foran organisationsuch as NEFCOto continue itsoperations evenin times of stress,as its presence be-comes even moreimportant whenother sources offinancing becomescarce.

last year. By expanding NEFCO’s businessoperations to Moldova we hope to be ableenvironmental benefits.to identify energy efficiency projects with

01NEFCO's ManagingDirector MagnusRystedt.

6

nefco 2012

nefco 2012

7

PATRIK RASTENBERgER

projects increased slightly in 2012 com-pared with the situation in 2011. Last year,over 33 per cent of all the projects financedby the Corporation’s main financial in-struments – the Investment Fund andFOCus arEathe Nordic Environmental DevelopmentFund – covered investments in renewableindustrial projects financed by NEFCO dur-ing the period also included measures thatbenefited the climate.turn, generated emission reductions that

projects to improve energy efficiency inmunicipally owned buildings in Ukraineand Russia. The Corporation’s Investmentenergy, equipment for environmental

FAIRWIND

NEFCO’s investments in energy-related

In 2012, NEFCO approved ten municipal

02

is funded by the Nordic Development Fund,

priate Mitigation Actions. The NCF, which

is now active across Sub-Saharan Africa,the Andean region and the poorest regionsof Asia, and it is currently working on inno-vative low-cost climate solutions that pro-

Fund approved three new energy-related

projects including investments in windmonitoring and energy efficiency meas-gave the green light to nine new projects,which all improved energy efficiency atall, the Corporation’s environmental statustotalling 8,412,992 megawatt hours. This1.3 million Danish households.ures. The Facility for Cleaner Productionthe production facilities concerned. All inreport shows that through its investmentsin 2012, NEFCO managed to save energyamount of energy corresponds to the an-nual energy consumption of approximatelyIn July 2012, NEFCO assumed the chair-

mote the development of local businesses.lapsed demand and market price, with over2 million emission reductions delivered to

Energyinvestments

energy or energy efficiency. Most of theimproved energy efficiency and this, inAccording to the Corporation’s envi-

ered good results, notwithstanding the col-

The core carbon market activity deliv-

public and private sector participants inits carbon funds. The portfolios were de-risked and consolidated during the year,and a record number of Clean Develop-ment Mechanism projects were registered.principally in Eastern Europe and Develop-developmental activities to promote thenational finance for climate action.The main areas of project focus remainrenewable energy and energy efficiency,ing Asia. NEFCO continues to undertakeconcept of market-based mechanisms asan important means of mobilising inter-

ronmental status report, the climate in-vestments in 2012 reduced carbon dioxideemissions by approximately 3.6 milliontonnes – a figure corresponding to theamount of carbon dioxide emitted by 11.7million persons travelling by aeroplanefrom Helsinki to Paris and back.

manship of the Steering Group of the East-ern Europe Energy Efficiency and Environ-

ment Partnership (E5P). The E5P, which2009, provides grant financing for energylending by international financial insti-tutions. Further progress was also madewith the DemoUkraina programme, which

was launched by a Swedish initiative inand environmental projects to supplement

is managed by NEFCO and the UkrainianMinistry for Regional Development, Con-struction, Housing and Municipal Econ-WARMTENETWERK

omy. The programme generated ten new01

projects in the Ukrainian district heatingsector using modern technology and dem-ing energy efficiency and reducing emis-is financed by the Swedish Governmentand the E5P.sions of greenhouse gases. DemoUkrainaNEFCO’s Carbon Finance and Funds de-onstrating Nordic experiences of improv-

partment broadened its climate financingactivities during 2012. Further progresswas reported with its technical assistanceand market readiness activities, notablywith the Nordic Climate Facility (NCF) andin the area of financing Nationally Appro-8nefco 2012

01DemoUkraina generatedten new projects in thedistrict heating sectorin 2012.02FairWind's installation ofwindmills in Ukraine.

nefco 2012

9

NORDIC INVESTMENT BANK

NEFCO’s work aimed at combating eu-trophication in the Baltic Sea continuedon many fronts in 2012. During this pe-riod, the BSAP Technical Assistance Fundallocated all of its remaining funds to fi-nance projects with a favourable impact onFOCus arEathe environmental condition of the BalticSea. The BSAP Fund, which was establishedin 2009 by the governments of Swedenand Finland to facilitate environmentalSea Action Plan, has been jointly admin-istered by NEFCO and the Nordic Invest-ment Bank.managed to allocate EUR 11 million to 34projects. Among its activities, the BSAPsewage treatment, modernised manureCasE studySince its inception, the BSAP Fund hasprojects as outlined in HELCOM’s Baltic

Workingfor a healthierBaltic Sea

Fund has facilitated investments in the

recycling of algae nutrients, improvedtreatment and supported the use of alter-native ship fuel. Since 2009, the Fund hasreplicable innovative technical solutions.financed projects valued at EUR 39 mil-lion, with the main focus on promotingfinding mission to Kingisepp, Russia, togather more information on the high nu-trient load found in the River Luga and itsish Environment Institute estimated thatthe annual phosphorus discharge fromKingisepp could be in excess of 1,000of HELCOM, NEFCO and the Ministries ofauthorities, to assess the situation. As aspecific source. HELCOM and the Finn-In February 2012, NEFCO joined a fact-

II

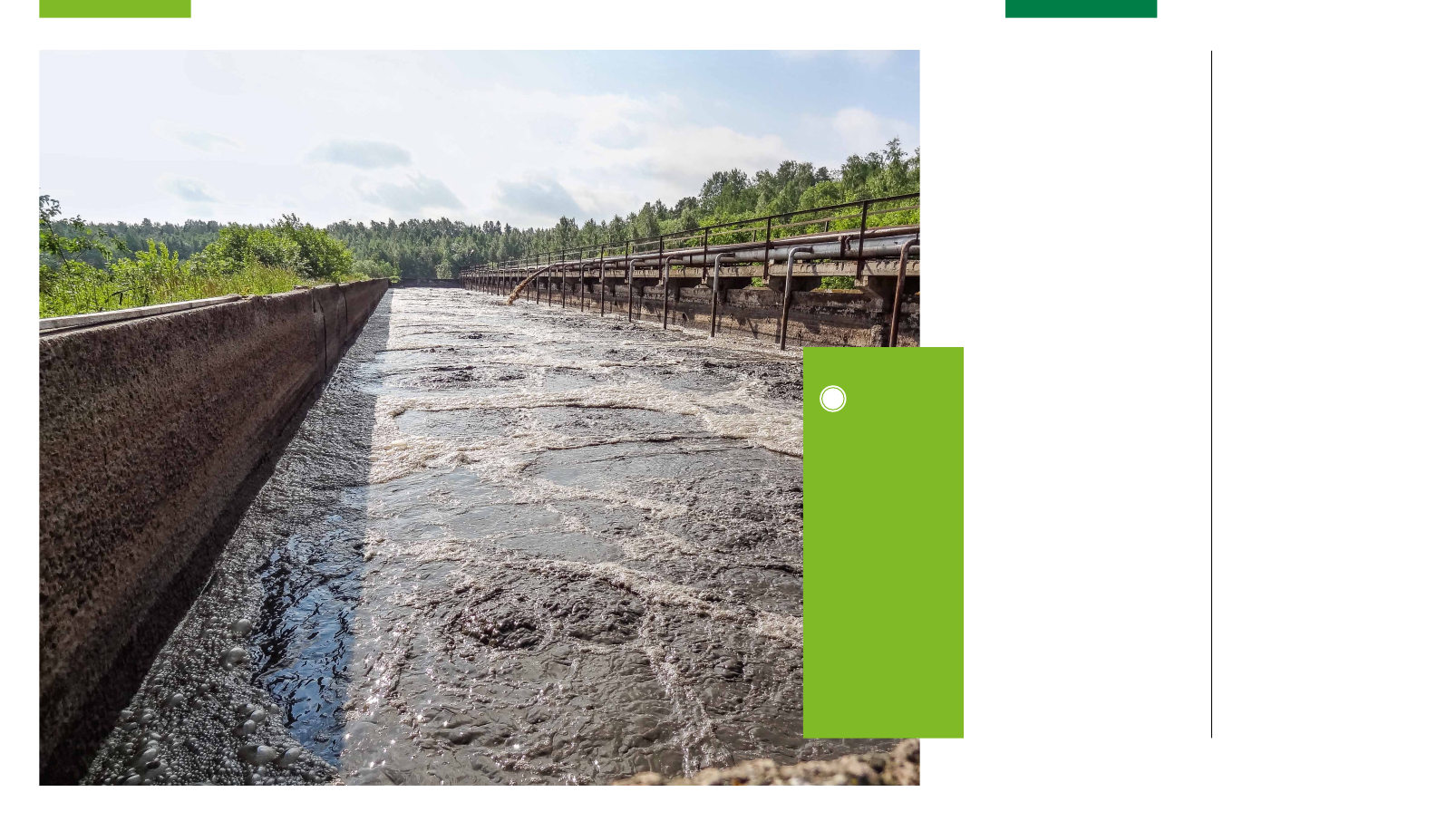

RussiaA cleaner futurefor Lake OnegaThe Finnish and Russiangovernments, togetherwith the PetrozavodskCommunal Utilities Sys-tems (PKS) and a groupof international financialinstitutions, signed a EUR32 million investmentpackage in July last yearto improve drinking waterquality and upgrade thewastewater treatmentfacilities in Petrozavodsk,Russia. NEFCO is provid-ing a EUR 4 million loanfor the project.

tonnes per year. The local fertiliser pro-ducer EuroChem invited representativesEnvironment of Finland and Russia, ac-companied by other Russian experts andresult of the investigation, the EuroChemleakage points, and measures were takento prevent further discharges of nutrientsinto River Luga and the Gulf of Finland.management was later able to identify the

Kingisepp signed a Memorandum of Un-

In April, NEFCO and the Municipality of

derstanding to finance the modernisation10nefco 2012nefco 201211

water treatment facilities. The results ofthe feasibility study for the project will behas approximately 50,000 inhabitants.In May, NEFCO and the water companyannounced in 2013. The city of KingiseppOKOS signed a loan agreement to reha-serving the towns of Svetlogorsk, Pionerskpreliminary calculations, the project willand Zelenogradsk in Russia. According toreduce phosphorus discharges by about13 tonnes per year, which is equivalent tounprocessed discharges from a populationof about 18,000. The project is part of an ex-tensive wastewater facilities rehabilitationprogramme that covers several small townsthe EU and Sweden.

ments in drinking water quality and aOnega in northwestern Russia. The cityhas approximately 270,000 inhabitants.EUR 4 million loan to the project.

reduction in untreated wastewater being

discharged from Petrozavodsk into LakeThe setup of the investment package wascoordinated by NEFCO, which provided aport for 2012 shows that the projects co-the reduction of phosphorus dischargesfigure for nitrogen was 5,832 tonnes. TheseNEFCO’s environmental status re-

bilitate wastewater treatment facilities

financed by the Corporation resulted inby 1,206 tonnes, compared to 1,126 tonnesfor the previous year. The correspondingfigures correspond to untreated wastewa-

and villages in the Kaliningrad region. Theprogramme gets financial backing fromIn July, the Finnish Ministry of the En-

ter discharges by about 1.8 million people.

CasE study

vironment, the Republic of Karelia, the(PKS) and a group of international finan-

III

City of Petrozavodsk, together with thecial institutions, signed a EUR 32 million

Petrozavodsk Communal Utilities Systems

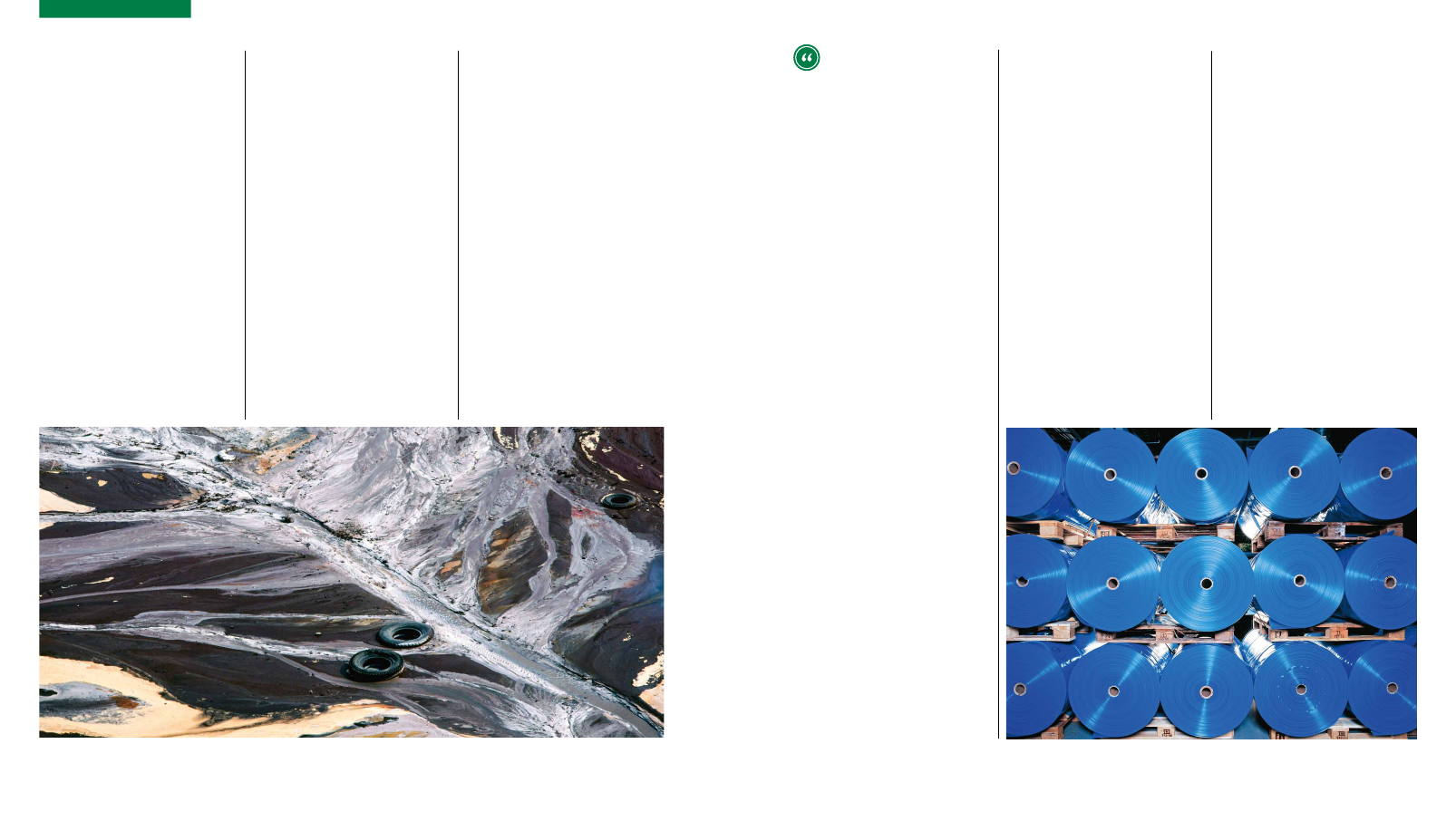

Lithuania /LatviaTreatmentof contaminatedsoilIn 2012, NEFCO decidedto increase its share capitalin the Danish-Lithuaniancompany DgE Baltic Soiland Environment, whichspecializes in engineeringand environmental consult-ing. One of DgE Baltic Soiland Environment’s focusareas is to examine andtreat contaminated soil andgroundwater at sites thatcould pollute the Baltic Sea.The capital injection will in-crease NEFCO’s stake to 36per cent of the company’sshare capital.

01PATRIK RASTENBERgER

01

01The seashore inNoarootsi (Nuckö),Estonia.

12

nefco 2012

nefco 2012

13

DgE BALTIC SOIL AND ENVIRONMENT

of the city’s water distribution and waste-

investment package to finance improve-

In 2012, NEFCO promoted a number ofprojects designed to reduce emissions ofvironmental toxins.toxic substances or persistent organic en-tors decided to increase the Corporation’sIn December, NEFCO’s Board of Direc-

substances from contaminated sites andwatercourses in Lithuania.DGE Baltic Soil and Environment to expandits operations to neighbouring Latvia andestablish an office in Riga, will increaseNEFCO’s stake to 36 per cent of the com-priority in Latvia will be to examine andassess contaminated soil and groundwatercould pollute the Baltic Sea.The capital injection, which will enable

also reduced the emissions of acidifying

Mitigatingenvironmentaltoxins

FOCus arEa

share capital in the Danish-Lithuanianwhich specializes in engineering and envi-

company DGE Baltic Soil and Environment,ronmental consulting. DGE Baltic Soil andEnvironment was established in the Lithu-anian capital Vilnius in 2005 and its activi-pesticide waste storage sites in Lithuania.ties have included examining and treating

pany’s share capital. The company’s mainat industrial facilities and other sites thatcility for Energy Saving Credits, a numberof municipal projects aimed at revampinging 2012. These projects also had a toxic-free component since the obsolete streetand mitigated.street lighting systems were financed dur-lights that were removed in many casescontained mercury, which was removedtrial projects financed by NEFCO in 2012Many of the energy-related and indus-Within the framework of NEFCO’s Fa-

contaminated soil and groundwater ata major environmental problem in EasternObsolete pesticide waste disposal is still

In 2012, theBarents Hot SpotsFacility approvedtwo projects aimedat improving thetreatment of solidwaste in Komi andPetrozavodsk inRussia.

substances, such as sulphur and nitrogen

is expected to reduce emissions of hazard-ous volatile organic compounds (VOC) byapproximately 870 tonnes per year.ernment decided to allocate NOK 3 mil-At the end of 2012, the Norwegian gov-

oxides, as a result of switching from heavymental status report shows that it succeed-22 per cent of Norway’s total emissions ofsulphur oxides in 2011. The total reductionsNEFCO in 2012 amounted to 1,957 tonnes.in nitrogen oxide emissions achieved by

crude oil to natural gas or renewable energyed in cutting down on sulphur oxide emis-sions by 4,212 tonnes, equivalent to about

sources. The Corporation’s 2012 environ-

lion to NEFCO’s Barents Hot Spots Facil-

ity (BHSF), which provides grants for theThese hot spots, identified by NEFCO andthe Arctic Monitoring and Assessment Pro-sions of toxic compounds or insufficientmanagement of solid waste or wastewater.gramme (AMAP) in 2003 include places

clean-up of the so-called environmentalhot spots in the Russian Barents region.

financed by NEFCO, went on stream in2012. As a raw material, the factory usestoxic polyvinylchloride (PVC). A NEFCO-financed paint factory in Odessa, Ukraine,polyethylene, which is expected to reducelocal production and consumption of thecommenced operations at the beginningof 2012. The new facility manufactureswater-based paints, which will replace thelocal production of oil-based paints. This02

The plastics film factory in Kaluga, co-

and sites with contaminated soils, emis-In 2012, the Barents Hot Spots Facility ap-the treatment of solid waste in Komi andPetrozavodsk in Russia.

Europe. Besides being a health hazard toticide waste also pollutes soil and ground-

proved two projects aimed at improving

both humans and animals, untreated pes-water sources. In 2011, DGE Baltic Soil andEnvironment treated and removed close to8,900 tonnes of environmentally harmful01SHEPARD SHERBELL / CORBIS SABA

01Contaminated soilsare cleaned up withfinancial back-up fromNEFCO's Barents HotSpots Facility.02The PVC-free plasticsfilm factory in Kaluga,co-financed by NEFCO,went on stream in 2012.

14

nefco 2012

nefco 2012

15

RANI PLAST

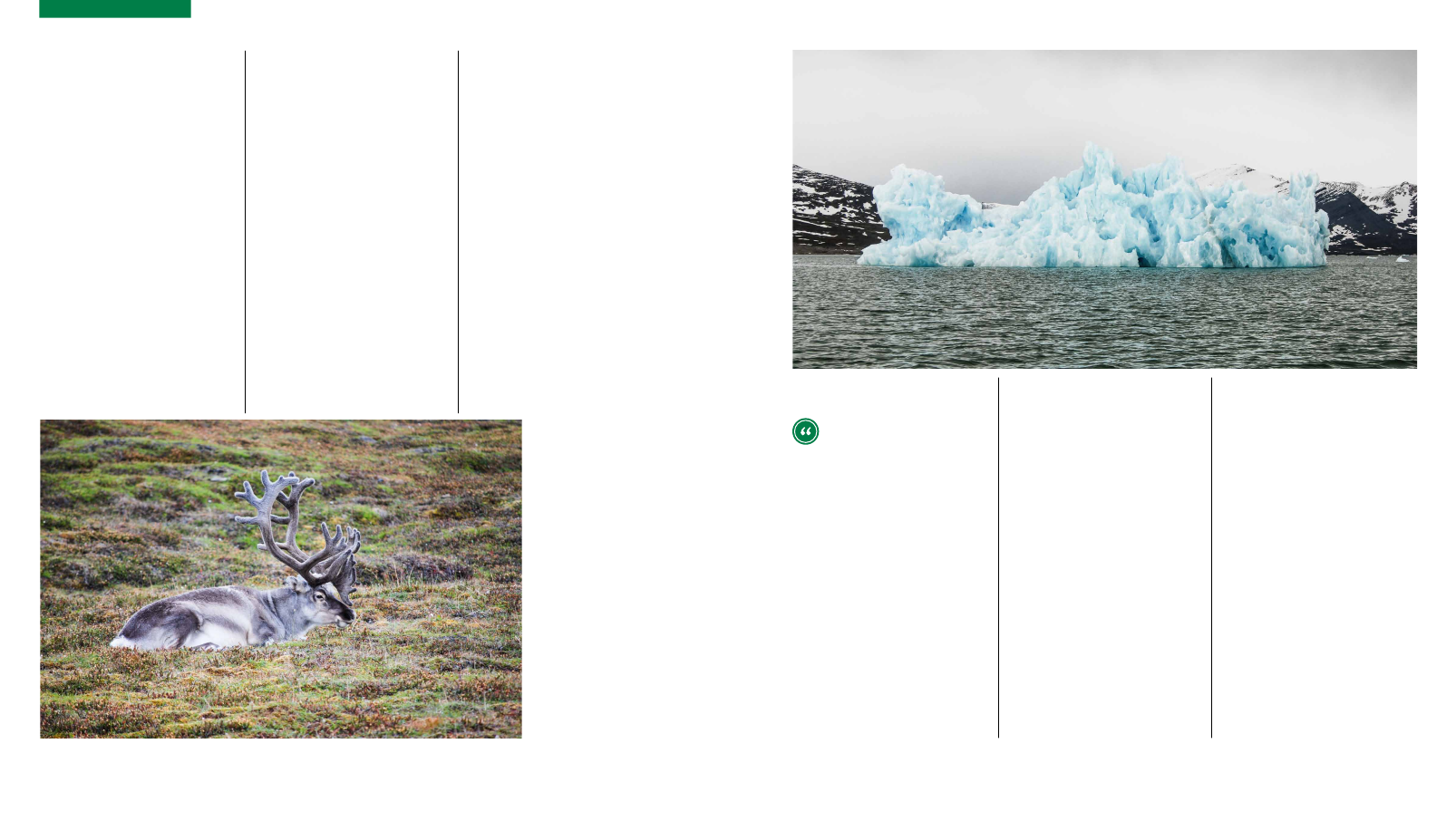

Arctic region in 2012. The preparation of

new investments and projects took placein the Murmansk, Archangel and Komiduring the period. In June, the U.S. Gov-Arctic Council’s environmental projects.which is administered by NEFCO.regions, and the corporation was activelyinvolved in the Arctic Council’s meetingsFOCus arEaernment decided to allocate funds to theThe funds will be allocated to the ArcticCouncil’s Project Support Instrument (PSI),The Arctic Council Project Support In-

parties.

finance a range of environmental projects inthe Russian Arctic, including mitigation ofshort-lived climate pollutants,” said Specialtenance Base for spent nuclear fuel wasAdviser Husamuddin Ahmadzai at NEFCO.removed from Murmansk harbour and

“The U.S. Contribution will enable us to

Environmentalinitiativesin the Arctic

In September, the Lepse Floating Main-

towed to Nerpa shipyard, some 40 kilome-tres from Murmansk. The decontaminationprocess will be carried out in a special shel-2014. The floating vessel’s uncontaminatedrecover spent fuel. The decontaminationsections will be scrapped and re-cycled,ter, which will be built on the slipway inand specialist equipment will be used toproject is being financed by the NorthernDimension Environmental Partnership(NDEP) programme and EBRD. NEFCO wasinvolved in the preparation of the project.02

strument, which was established by the

Arctic Council in 2005, is a financial ini-abatement and elimination of the releaseof hazardous substance such as persistentto contributions from the Arctic Council

tiative that aims to focus on actions pre-venting pollution of the Arctic, including

organic pollutants and mercury, and miti-

gation of climate change. The PSI is open

01SVENOLOF KARLSSON

The Lepse FloatingMaintenance Basefor spent nuclearfuel was removedfrom Murmansk fordecontamination.01Reindeer lichen isbadly affected byemissions of sulphuroxides and heavymetals in the Arcticregion.02Svalbard.Arctic waters.

decided to allocate additional funds to

In December, the Swedish government

timates of the radiative forcing of blackafter CO2 and methane.

NEFCO and Sweden’s joint trust fund on

carbon indicate that it may be the secondor third leading cause of global warmingIn 2009, eight member states belonging

mitigation of short-lived climate forcers(SLCF). The SLCF Fund was established intection Agency and NEFCO.The Trust Fund, which is administered2010 by the Swedish Environmental Pro-by NEFCO, gives priority to projects identi-fied by the Arctic Council’s Steering Groupin the Russian Arctic.on SLCF. The fund currently has access toThe main aim of the Fund is to financeSEK 2,550,000 for environmental projectsRussian projects that reduce SLCF emis-is a potent climate-forcing aerosol thatremains in the atmosphere for only a fewdays or weeks. Black carbon is a compo-combustion of fuels such as oil, diesel, coal,nent of soot and a product of incompletewood, crop waste and other biomass. Es-nefco 2012

to the Arctic Council signed a declaration inother short-lived climate forcers, includingmethane and tropospheric ozone, may pose

Tromsø that stated that black carbon anda particular threat to the Arctic and thatreducing these forcers has “the potentialto slow the rate of Arctic snow, sea ice andsheet ice melting in the near term.”

sions, including black carbon. Black carbon

16

nefco 2012

17

SVENOLOF KARLSSON

NEFCO strengthened its focus on the

members, observers and other interested

01

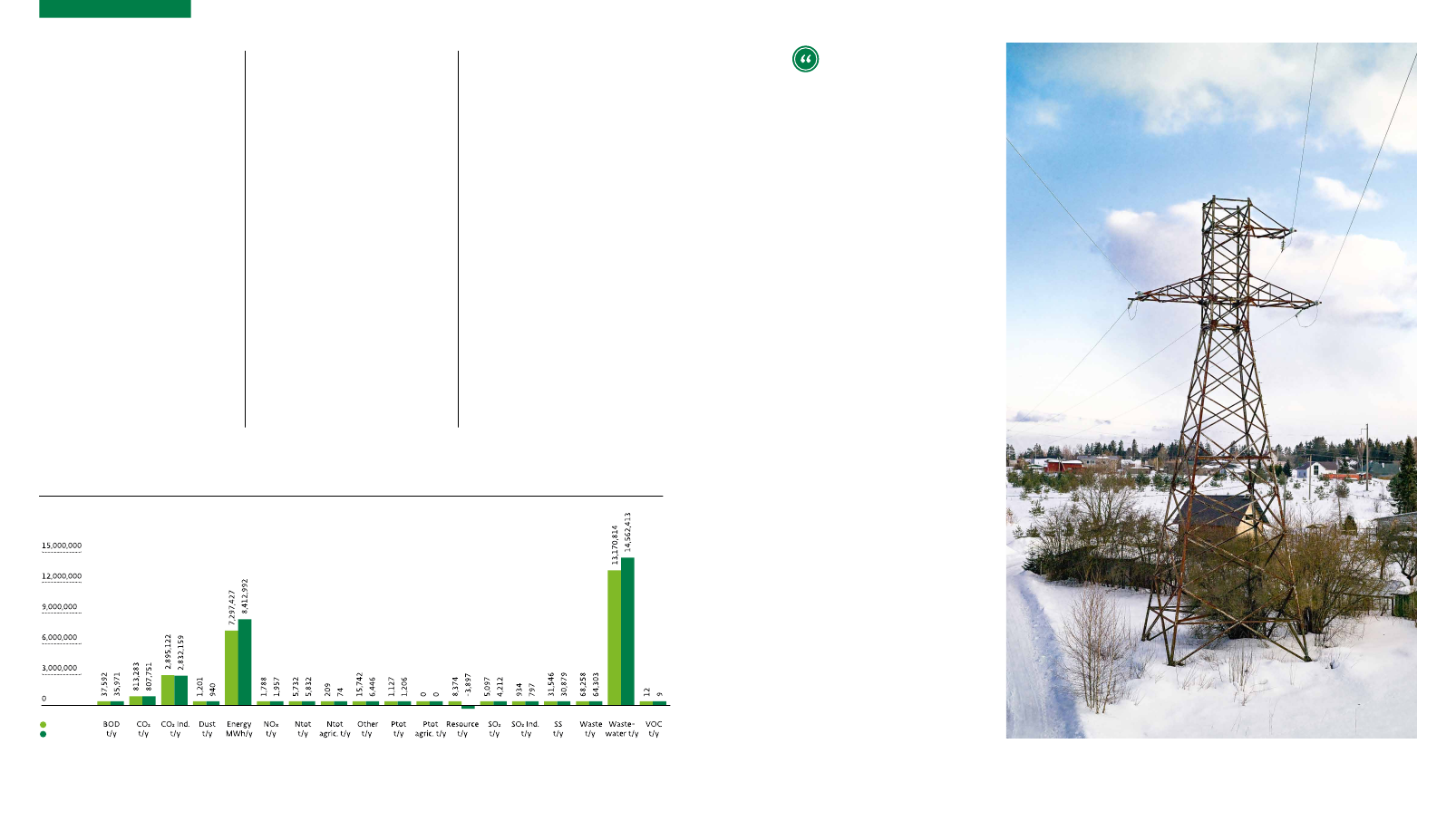

In terms of the dominant indicators CO2

and energy, the overall environmental re-

increased, major progress was made in this

sults achieved in 2012 fell slightly short ofthe projects are still missing. No progress

respect in 2012. An energy project tabled in

the 2011 levels. This is due to depreciationcharges and the fact that data on some ofEMissiON rEduCtiONswas made in the substantial reductions inindirect CO2 emissions reported last year.phorus (P) exceed the previous year’s lev-The figures for nitrogen (N) and phos-els by a narrow margin. This is due to the

Russia no longer affects the outcome, whileat the same time wind power productionsector performed positively in terms of CO2reductions took place in 2012.In NEFCO’s industrial projects, the ratereductions. Overall, no major changes inof reduction in CO2 emissions slowed downthat NEFCO writes down environmentalin the Baltics expanded. On the whole, the

Environmentalstatusreport 2012

fact that the performance of on-goingSouthwest Wastewater Treatment Plant3

during 2012. This has to do with the factreductions by 5 % per annum over a periodof 20 years for projects that have been con-NEFCO´s portfolio are however performingas expected. Similarly, the slightly lowercluded. Projects that are currently active inreductions in nitrogen and sulphur ox-reduction in wastes indicates that industryin NEFCO’s host countries is improving itsresources in its processes.

wastewater projects has further improved.Because of the dominant position of thein St. Petersburg in terms of volumes (80impact was excluded from the 2012 figuresindicating the volume of wastewater treat-the water sector continued to show goodperformance in 2012.

In 2012, NEFCOinitiated use ofa new indicator,namely blackcarbon, to theenvironmentalmonitoringof all projectsfinanced by theCorporation.

million m ) and energy consumption, itsed. This was also the case in 2011. Overall,Within the energy sector projects, the

ides can be explained by write-offs. Thatindustrial projects lead to higher rates of

rate of reduction in carbon dioxide emis-

performance in recovering and recyclingindicator, namely black carbon, to theIn 2012, NEFCO initiated use of a new

sions increased slightly compared to 2011.

Unlike in 2011, when energy consumption

Figure 1NEFCO: Total reductionsFigure 1BOD Biochemical oxygen demandCO2 Carbon DioxideMWh Megawatt hoursNox Nitrogen oxidesNtot Nitrogen totalPtot Phosphorus totalSO2 Sulphur oxidesSSSuspended solidsVOC Volatile organic compoundst/yTonnes per year

20112012

01NEFCO managed to reduceelectricity consumptionby 8,412 gWh throughits investments in 2012.

18

nefco 2012

nefco 2012

19

PATRIK RASTENBERgER

environmental monitoring of applica-ble projects financed by the Corporation.fuels such as oil, diesel, coals, wood, cropBlack carbon is a component of soot andwaste and other biomass. Estimates sug-is a product of incomplete combustion ofgest that black carbon may be the secondafter CO2 and methane.

ceed with additional considerations andreporting.tions recognised that approaches to GHGpossible, recognising the differing man-dates and geographical coverage of eachimprove consistency and comparabilityThe International Financial Institu-

accounting should be harmonised as far asinstitution. A harmonised approach willacross IFIs, provide increased reliability forstandard for other IFIs and facilitate thesharing of experience and lessons learnt.other users of the data, set a good-practiceNEFCO has, during the period underNEFCO iN NuMbErs

NEFCO has,together withother InternationalFinancial Institu-tions, worked onfinding a harmo-nised approachto project-levelgreenhouse gas(GHG) accounting.

or third leading cause of global warmingworking groups which are supporting at-tempts to harmonise the environmentalmethodology applied at Internationalunder review, Senior Manager Karl-JohanLehtinen from NEFCO participated inmeetings hosted by the Working Groupon Environment for Multilateral FinancialInstitutions.Moreover, NEFCO has, together withNEFCO engaged actively in various

Financial Institutions. During the period

review, sought to identify new innovativebenefits. The Baltic Sea Action Plan Fund,nutrients, improved sewage treatment,utilised unique innovative solutions foradministered by NEFCO and NIB, facili-manure treatment and ship fuel. Many ofreducing discharges of nutrients to the

approaches to obtaining environmentaltated investments in the recycling of algaethe projects financed from the Fund haveBaltic Sea. One good example of this is theprocess, which produces renewable energyand biocoal.

Examplesof emissionreductionsin 2012

other International Financial Institutions,worked on finding a harmonised approachto project-level greenhouse gas (GHG) ac-counting. The rationale for this work is toappraisal. The purpose in undertaking thisharmonise GHG accounting during projectwork is to establish minimum require-ments which each IFI can optionally ex-

CO23.6 million tonnes=11.7 million personstravelling by airplane,back and forth, fromHelsinki to Paris

SOx4,212 tonnes=22 % of Norway’stotal SO2 emissionsin 2011

treatment of manure using the pyrolysis

01PATRIK RASTENBERgER

01NEFCO managedto reduce nitrogendischarges to theBaltic Sea by 5,832tonnes in 2012.

Symbols: “Faucet” byKenneth Von Alt, “EiffelTower“ by CamilaBertoco, “Lightning“ byRyan Oksenhorn, fromthenounproject.comcollection.

P1,206 tonnes=Untreated waste-water from 1.8million peoplenefco 2012

Electricity reduction8,412 GWh=The annual electricityconsumption of1.3 million people inDenmark21

20

nefco 2012

PATRIK RASTENBERgER

The dire state of the economy in Europecontinued to affect the Corporation’s op-erations. For NEFCO, it meant that a longerperiod of time was required for planningreceived more inquiries than ever beforeinvestments and that fewer projects were

approved, even though the Corporation

Report ofthe Boardof Directors2012

over the years. Consequently, general inter-remained high, suggesting that interna-tional financial institutions serve an im-conditions.At the same time, overall interest in

est in the funding available from NEFCOportant purpose even under less favourableenvironmental investments among mu-nicipalities has increased. A number ofmunicipal projects to build up districtheating and water management capacity

were identified for closer scrutiny duringextensive experience in municipal envi-ronmental investments and the growinginterest in Russia and Ukraine is perceivedCasE studya result of the cooperation and project sup-

the reporting period. NEFCO possesses

as an important positive development andport provided by the Northern DimensionRussia and the Eastern European EnergyEfficiency and Environment Partnership(E5P) in Ukraine.activity. A total of 65 new projects wereThe year was one of vigorous projectEnvironmental Partnership (NDEP) in

IV

UkraineLighting upZhytomyr

The Municipality ofZhytomyr and NEFCO areimplementing an energyefficiency project aimed atreplacing street lights withnew LED lights, which willreduce energy consump-tion by approximately 80per cent. The city, togeth-er with NEFCO, has alsoinvested in energy-savingrefurbishment of munici-pally owned buildings.

approved in 2012 by the various funds

managed by NEFCO as compared to 66jects financed by the NEFCO Investmentresponding figure for 2011 was EUR 13.5

the year before. The volume of new pro-Fund fell to EUR 5.7 million while the cor-million. However, the value of provisionallyapproved projects amounted to EUR 51.8

million, much higher than the 2011 levelthere were 46 active projects financed byNEFCO’s principal fund, the NEFCO In-vestment Fund, with total investmentsamounting to EUR 115.9 million. As dis-

of EUR 28.7 million. At the end of 2012,

bursements are made with a certain delay,22nefco 2012nefco 201223

a larger proportion of NEFCO’s resourceswas actually allocated than indicated inthe statement of financial position.Just like the operations of the Invest-

water project in Petrozavodsk, Russia; andfunding from the Eastern Europe EnergyEfficiency and Environmental PartnershipUkraine.(E5P) for financing an energy-efficientdistrict heating demonstration project inAt the end of the year, NEFCO had 27

assessment of the environmentalimpact of projects

Helsinki, 7 March 2013

ment Fund, NEFCO’s other main line ofactivity – fund management – was also

successful. In June 2012, NEFCO signed anagreement with the USA on participationin the Project Support Instrument (PSI) tobe administered by NEFCO on a mandatefrom the Arctic Council.One of the Corporation’s climate funds

funds (excluding the Investment Fund)with total assets of EUR 346 million un-der management. NEFCO renders separatenancial position.accounts for all these funds. The funds arenot included in NEFCO’s statement of fi-The financial result was modest, which

– the Baltic Sea Region Testing GroundFacility (TGF) – completed its primaryinvestment phase with the expiry of thefirst commitment period under the KyotoProtocol in 2012. The other climate fund,NEFCO Carbon Fund (NeCF), cut down onsult of the weak market for emission rights.several years to come, investments in newon managing its existing agreements.purchase agreements will most likely beits investment activities drastically as a re-While NeCF will continue to operate forlimited and the fund will primarily focusfive dissolved during the reporting period.Swedish funding was made available forenvironmental projects in Russia; fundingfrom the Northern Dimension Environ-mental Partnership (NDEP) for a waste-Three new funds were established and

was mainly due to the foreseen appropria-

tion of EUR 1.5 million for NEFCO’s contri-

A total of 65new projectswere approvedin 2012 by thevarious fundsmanaged byNEFCO as com-pared to 66 theyear before.

In line with the procedures developed overtime by NEFCO, each project is assessedin terms of its expected environmentalimpact before a decision on financing ismade, followed by a review of the actualanalysis of the projects launched underboth the Investment Fund and the Envi-effects upon completion of the project. Theronmental Development Fund indicates67 on-going projects assessed in terms ofenvironmental impact, 15 were deemed toexpected level and 14 failed to meet expec-128 have been completed.Harald RensvikChairman

This is a shortened versionof the Report of the Boardof Directors. The full reportis available at www.nefco.org/newsroom/annual_reports

that, on average, the positive environmen-

tal impacts are at the expected level. Of thehave exceeded expectations, 7 were at thetations. In 30 cases, no conclusions couldyet be drawn. Of all the analysed projects,environmental cost-effectiveness of pro-jects in relation to the cost of attainingNEFCO also systematically assesses the

Deputy Chair

Jon Kahn

bution to the Nordic Environmental De-velopment Fund (NMF). This was the lasttranche of NEFCO’s total commitment ofthe past three years. In all other respects,losses provided no surprises.As expected, environmental perfor-EUR 5.75 million to the NMF fulfilled overthe net balance between capital gains andmance during the reporting period wasalso sound compared to previous years. Amore detailed account of environmentalperformance is presented in the annex.NEFCO’s area of operations was ex-

Danfríður Skarphéðinsdóttir

comparable levels of emission reductionscosts of NEFCO’s projects are roughly oneeighth of the corresponding project costsin the Nordic countries.personnelAt the end of 2012, NEFCO had 30 employ-advisor. NEFCO also engages consultants.Financial resultees, one of whom was a part-time special

Søren Bukh Svenningsen

in the Nordic countries. On average, theAnn-Britt Ylinen

panded during 2012 when the Board ofDirectors authorised NEFCO to commenceoperations in Moldova. Underlying thisEurope Energy Efficiency and Environ-expansion was the decision of the Easternmental Partnership (E5P) to intensify itsefforts in the country. Cooperation withinEuropean Investment Bank (EIB); the Nor-dic Investment Bank; the World Bank; andthe European Bank for Reconstruction and

Managing Director

Magnus Rystedt

this E5P partnership is carried out by the

The financial statements show a surplus ofEUR 27,499.73. In accordance with previousin the form of retained earnings.practice, the Board of Directors proposesthat the surplus be allocated to operations

Development (EBRD). E5P finances ener-schemes funded by the Nordic and Balticin 2013, by Moldova. NEFCO has held theas of July 2012.24nefco 2012

gy-efficiency and other environmentalcountries, the EU, the USA, Ukraine and,presidency of the E5P management team

nefco 2012

25

Statement ofcomprehensiveincome1 January — 31 december

FiNaNCial statEMENt

(Amounts in EUR)

2012

2011

incomeInterest income, placements with creditinstitutionsInterest income, lendingNet result of financial operationsOther incometotal income8782431446568-16066544795214551337211331491025875-54971348027456412056

Statementof financialposition31 december

FiNaNCial statEMENt

(Amounts in EUR)

2012

2011

assEtsCash and cash equivalentsPlacements with credit institutionstotal cash, cash equivalents andplacements with credit institutions48390131073496121121886253792488778747438116672325

Other receivablesAccrued interest

23919486599223579115164538273750836286766226157112491

173944838569182964421575382739218433001113813155700774

Operating expensesAdministrative expensesDepreciation and write-down invalue of tangible and intangible assetsForeign exchange gains and lossesImpairment of loans / reversalstotal operating expenses546587823047-33493304415485872538024219172117939628315580184

Loans outstandingInvestment assetsOther placementsIntangible assetsTangible assetstOtal assEts

rEsult FOr thE yEar

27500

831872

liabilitiEs aNd EQuityliabilitiesOther liabilitiesEquityPaid-in capitalReserve for investment/credit lossesOperational fundRetained earningsResult for the yeartotal equity1134065602455717745000001248871127500154979947113406560245571774500000116568398318721549524472 132 544748 327

tOtal liabilitiEs aNd EQuity

157112491

155700774

26

nefco 2012

nefco 2012

27

(Amounts in EUR 1,000)

2012

2011

Cash flow from operating activitiesResult for the year2723-1683185-451-2483219-1500301763663-316

Changesin equity

FiNaNCial statEMENt

proposed allocation of the year's result

2012

2011

Appropriation to the retained earningsrEsult FOr thE yEar

2750027500

831872831872

Cash flowstatement

FiNaNCial statEMENt

Depreciation and write-down in value of tangible andintangible assetsValue adjustments, investment assetsValue adjustments, other placementsCapital adjustments, other placementsImpairments, lendingChange in accrued interestsLendingDisbursements

1 January — 31 december

-1192438262919333--41-700-4143

-68212064---594104144-2352

paid-in capital

Repaymentsreserve forinvestment/credit lossesOperationalFundresultfor the yearPremature repaymentsRealised credit lossestotalCapitalisation of interest and loan receivablesExchange rate adjustmentsChange in investment assetsCash flow from operating activitiesretainedearnings11197961458877-

(Amounts in EUR)

Equity as of 1 January 2011Appropriation to the retained earningsAppropriation to the reserve forinvestment/credit lossesAppropriation to the Operational FundPaid-in capitalResult for the yearEquity as of 31 december 2011

113406560

24557177

4500000

458877-458877

154120576---

Cash flow from investing activitiesChange in placements with credit institutionsChange in other placementsChange in other receivables and liabilities, netChange in tangible and intangible assetsNet cash flow from investing activities-28602-16971370-14-289432701-2535-745-22-602

-83187211340656024557177450000011656838831872

-831872154952447

Equity as of 1 January 2012Appropriation to the retained earningsAppropriation to the reserve forinvestment/credit lossesAppropriation to the Operational FundPaid-in capitalResult for the yearEquity as of 31 december 2012

113406560

24557177

4500000

11656838831872

831872-831872

154952447---Change in cash and cash equivalents-33086-2954

-

breakdown of cash and cash equivalentsCash and balances with banksPlacements with a maturity of less than six months4839-790430021

-275001134065602455717745000001248871127500

-27500154979947

tOtal Cash aNd Cash EQuivalENts

4839

37925

28

nefco 2012

nefco 2012

29

In our capacity as auditors appointed by

the Control Committee of the Nordic En-vironment Finance Corporation we havethe statement of financial position as at 31audited the accompanying financial state-ments of the Corporation, which compriseDecember 2012, and the statement of com-prehensive income, statement of changesin equity and statement of cash flows forexplanatory notes.the year then ended, and a summary ofsignificant accounting policies and otherthe board of directors’ and the Managingdirector’s responsibility for the financialstatementsThe Board of Directors and the ManagingDirector are responsible for the preparationtional Financial Reporting Standards, andfor such internal control as they determineof the financial statements that give a trueand fair view in accordance with Interna-is necessary to enable the preparation offraud or error.

presentation of the financial statements in

order to design audit procedures that are

In accordance with section 9 of the statutes

appropriate in the circumstances, but not

of the Nordic Environment Finance Corpo-

We recommend to the Nordic Council ofMinisters that:●the profit for the financial year be treated●the Statement of Comprehensive In-come and the Statement of FinancialPosition be adopted, and●the Board of Directors and ManagingDirector be discharged from liability forthe administration of the Corporation’sod examined by us.operations during the accounting peri-Helsinki, 7 March 2013Bill Fransson

Thomas Jensen

as proposed by the Board of Directors,

for the purpose of expressing an opinioncontrol. An audit also includes evaluatingthe appropriateness of accounting policiesestimates made by management, as wellthe financial statements.We believe that the audit evidence we

ration, we have been appointed to ensureand to bear responsibility for the audit ofthe Corporation. Having completed our

on the effectiveness of the entity’s internalused and the reasonableness of accountingas evaluating the overall presentation ofhave obtained is sufficient and appropriateto provide a basis for our audit opinion.OpinionIn our opinion, the financial statementsgive a true and fair view of the financial po-sition of the Nordic Environment FinanceCorporation as of 31 December 2012, andof its financial performance and its cashflows for the year then ended in accordanceAccounting Standards Board.

that the operations of the Corporation are

conducted in accordance with the Statutesassignment for the year 2012, we herebysubmit the following report.

IndependentAuditors’Report

Statementby the ControlCommittee

financial year as well as after the Corpo-

The Control Committee met during the

ration’s financial statements had beenprepared, whereupon the necessary con-trol and examination measures were per-March 2013, at which time we also received2013 by the authorised public accountantsappointed by the Control Committee.Following the audit performed,we note that:●the Corporation’s operations during theformed. The Corporation’s Annual Reportwas examined at a meeting in Helsinki on 7the Auditor’s Report submitted on 7 March

Hans Frode Kielland Asmyhr

Åsa Torstensson

Tuula Peltonen

Ragnheiður Rikhardsdóttir

financial statements that are free frommaterial misstatement, whether due toauditor’s responsibilityOur responsibility is to express an opin-ion on these financial statements based onour audit. We conducted our audit in ac-cordance with International Standards onAuditing. Those standards require that weand perform the audit to obtain reasonableassurance whether the financial statementsare free from material misstatement.An audit involves performing procedurescomply with ethical requirements and plan

with International Financial ReportingStandards as issued by the Internationalreport on the other requirementsIn accordance with the Terms of Engage-ment our audit also included a review ofwhether the Board of Directors’ and theManaging Director’s administration havetion of the Board of Directors and the Man-of the Corporation.

financial year have been conducted inaccordance with the Statutes, and thatfair view of the financial position of theCorporation as at 31 December 2012 andshows a profit of EUR 27499,73.

●the financial statements give a true and

complied with the Statutes of the Corpora-tion. It is our opinion that the administra-aging Director complied with the StatutesHelsinki, 7 March 2013Sixten Nyman

KPMG Oy AbAuthorised Public AccountantPer Gunslev

of its results and cash flows in 2012. The

Statement of Comprehensive Income

to obtain audit evidence about the amountsand disclosures in the financial statements.The procedures selected depend on the au-ditor’s judgment, including the assessmentfinancial statements, whether due to fraudevant to the entity’s preparation and fair30nefco 2012of the risks of material misstatement of theor error. In making those risk assessments,the auditor considers internal control rel-

State Authorised Public AccountantKPMG StatsautoriseretRevisionspartnerselskabnefco 201231

iNvEstMENt FuNd (iF)iNvEstMENts (3)russiaEquipment for environmen-tal monitoring (Finland)ukraineInstallation and mainte-nance of wind generators(Denmark)ukraineEnergy efficiency measuresat municipal buildings(Sweden)supplEMENtaliNvEstMENt (1)latvia and lithuaniaEngineering andenvironmental consulting(Denmark)

ExprEssiONs OFiNtErEst (21)ukraineProduction of solar energy(Denmark/Sweden)ukraineModernisation of thedistrict heating system inDonetsk (Sweden)ukraineEnergy-saving measures inmunicipally owned build-ings in Zhytomyr (Sweden)russiaProduction of constructionmaterials (Finland)ukraineService and maintenance ofwindmills (Denmark)ukraineProduction of constructionmaterials (Denmark)ukraineModernisation of thedistrict heating system inSeverodonetsk (Sweden)ukraineCentralised monitoring ofthe consumption of elec-tricity, heat and water inhousing (Denmark)russiaWater and wastewatertreatment in Kingisepp(BSAP TA/NDEP)ukraineEnergy service measuresat municipally ownedbuildings (Sweden)russiaModernisation of thedistrict heating system inKomi (Finland/NDEP)

russiaAutomatic cleaningof district heating pipes(Denmark/Sweden)russiaLoan programme forenergy-saving projectsin the private sector(Denmark/Finland)russiaProduction of materials inthe construction industry(Finland)russiaUpgraded energy efficiencyin the district heating sectorin Karelia (Finland/Sweden)ukraineLoan programme forenergy-saving projectsin the agricultural sector(Nordic technology)russiaModernisation of thetransport sector (Finland)russiaProduction of biogasat landfills in gatchina(Sweden)russiaBiogas from poultry manure(Sweden)belarusEquipment for district heat-ing networks (Denmark)russiaUpgrading of streetlighting in Petrozavodsk(Finland/Sweden)

NOrdiCENvirONMENtaldEvElOpMENt FuNd(NMF)iNvEstMENts (2)ukraineguarantee facility for grantfinancing for environmentalprojects (NDEP/E5P)russiaguarantee facility for po-tential currency exchangerate losses for rouble loans(NEFCO IF)apprOvEd ClEaNErprOduCtiON prOJECts(9)ukraineBoiler room modernisationrussiaModernisation of heatingsystemsukraineUpgrading of the heatingsystem at a sanatoriumukraineModernisation of bitumi-nous concrete productionfacilitiesukraineModernisation of theproduction process in thefurniture industry to makeuse of the wood wastegenerated

ukraineUpgrading of equipment foragricultural productionukraineModernisation of theproduction process in themanufacture of concreteukraineBoiler room modernisationand upgrading of heatingsystem in ZhytomyrukraineReservation of funds for theenergy efficiency pro-gramme DemoUkraina IIapprOvEd ENErgysaviNgs CrEditsprOJECts (9)ukraineEnergy efficiency measuresat a day care centre andimproved street lighting inZhytomyrukraineUpgrading of the streetlighting in gorlivkaukraineRefurbishment of kitchenfacilities in school buildingsrussiaEnergy efficiency measuresin 10 municipally ownedbuildings in PetrozavodskukraineBoiler room modernisationat the municipal hospital inAlchevskukraineEnergy efficiency measuresin municipally owned build-ings in Konotop

ukraineEnergy efficiency meas-ures in municipally ownedbuildings in the educationalsectorukraineEnergy efficiency measuresin 5 municipally ownedbuildings in KramatorskukraineEnergy efficiency measuresin municipally ownedbuildings in the educationalsector in PavlogradsupplEMENtaliNvEstMENt (1)ukraineEnergy efficiency measuresin 9 municipally ownedbuildings in Ivano-FrankivskapprOvEd barENtshOt spOts FaCilityprOJECts (3)KareliaInitial assessment of wastetip in PetrozavodskKareliaConsulting framework forinvestment projects in theenergy sector in KareliaKomiPreparation of investmentin the solid waste sector inKomi

CarbON FiNaNCE aNdFuNds (CFF)tEstiNg grOuNdFaCility (tgF)2 new purchaseagreementsNEFCO CarbON FuNd(NECF)1 new purchase agreementNOrdiC CliMatEFaCility (NCF)13 new projects

Approvedprojects2012

32

nefco 2012

nefco 2012

33

distribution by sector

distribution by countryCasE study

V

UkraineFair winds forUkraineWater 27 %Agriculture 1 %Waste 3 %Energy 33 %Industry 36 %Estonia 9 %Latvia 11 %Lithuania 10 %Poland 11 %Russia 45 %Ukraine 11 %Belarus 2 %Slovakia & Czech Rep. 1 %

NOrdiC ENvirONMENtal dEvElOpMENt FuNd (NMF)distribution by sectordistribution by country

The Danish companyFairWind A/S specializesin the erection, installa-tion and maintenance ofSiemens and Vestas windgenerators. Vestas andFairWind plan to installapproximately 30 windgenerators in Ukraine by2013. The scheme will befinanced by NEFCO, theDanish Investment Fundfor Developing Countries(IFU) and FairWind.The cost of the projectis approximately EUR1.2 million.

Water 17 %Agriculture 10 %Waste 14 %Energy 33 %Industry 26 %

Estonia 5 %Latvia 8 %Lithuania 7 %Poland 2 %Russia 52 %Ukraine 23 %Belarus 1 %Other 2 %

34

nefco 2012

nefco 2012

35

JIM CRAIgMyLE / CORBIS

iNvEstMENt FuNd

bOard OF dirECtOrs2012dENMarKsøren bukh svenningsenHead of Division, Environ-mental Protection Agency/Ministry of the Environment

iCElaNdMagnús Jóhannesson,Secretary general, Ministryof the Environment (untilJanuary 2013)danfríðurskarphéðinsdóttirSenior Adviser, Ministry ofthe Environment, AlternateNOrWayharald rensvikSecretary general, Ministryof the Environment, ChairJan thompsonSenior Adviser, Ministry ofthe Environment, Alternate

sWEdENJon KahnDirector, Ministry of theEnvironmentlars ElfvinSenior AdministrativeOfficer, Ministry for ForeignAffairs, AlternateObsErvErsMats EkengerSenior Adviser, NordicCouncil of Ministerssøren Kjær MortensenSenior Director, Headof Origination, NordicInvestment Bank

CONtrOl COMMittEEChairmanbill FranssonDirectordenmarkthomas JensenMember of ParliamentFinlandtuula peltonenMember of Parliamenticelandragnheiður rikhardsdóttirMember of ParliamentNorwayhans Frode KiellandasmyhrMember of ParliamentswedenÅsa torstenssonMember of ParliamentauditOrssixten NymanAuthorised PublicAccountant KPMg Finland,Helsinkiper gunslevAuthorised Public AccountantKPMg Denmark, CopenhagensECrEtary tO thECONtrOl COMMittEEbirgitta immerthalAuthorised PublicAccountant, KPMg Finland,Helsinki

pErsONNEl 2012Magnus rystedtManaging Directorhusamuddin ahmadzaiSpecial Adviser Environ-ment and TechnologyMia alénLoan Administratortita anttilaChief CounselMarie baltzari-setäläAssistantamund beitnesInvestment ManagerJanika blomLegal CounselCarbon Finance and Fundsulf bojöSenior Investment Manageraliona FomencoProject OfficerCarbon Finance and Funds(until March 2013)henrik ForsströmSenior AdviserBarents Hot Spots Facility

peter henningsenInvestment Manager(until July 2012)Kari homanenVice PresidentKari hämekoskiManagerCarbon Finance and FundsFredrik larssonAnalystKarl-Johan lehtinenSenior ManagerEnvironmental Affairshelle lindegaardSenior Legal AdviserMaria MaliniemiInvestment Managertina NybergAssistantCarbon Finance and Fundsbo Eske NyhusSenior Investment Manager(from April 2012)anja NysténSenior AdviserCarbon Finance and FundsElisabet paulig-tönnes,Senior ManagerProject AdministrationMaija saijonmaaProject ManagerCarbon Finance and Funds

ash sharmaVice PresidentCarbon Finance and FundsJulia shevchukChief Investment AdviserRepresentative Office inKiev, Ukraineheli sinkkoLegal AssistantMikael sjövallCommunications Managertua skandLoan Administratorthor thorsteinssonInvestment ManagerMarina valkonenAssistant to the ManagingDirectortorben vindeløvExecutive Vice PresidentJohan WillertSenior AdviserEmilie yliheljoLegal CounselCarbon Finance and Funds(until September 2012)

Personnel

2012

Carl bjørn rasmussenHead of Section, Environ-mental Protection Agency/Ministry of the Environ-ment, AlternateFiNlaNdann-britt ylinenDirector, Ministry of theEnvironmentKristiina isokallioDirector, Ministry of theEnvironment, Alternate

01PATRIK RASTENBERgER

01Clockwise: Ann-Britt ylinen,Magnus Rystedt, Jon Kahn,Harald Rensvik, Søren BukhSvenningsen, DanfríðurSkarphéðinsdóttir

36

nefco 2012

nefco 2012

37

Five yearcomparison

NEFCO iN NuMbErs

Number of projects approved by NEFCO’s board of directors

the total value of funds administered by NEFCO

At the end ofthe year, NEFCOhad 28 fundswith total assetsof EUR 549million undermanagement.38nefco 2012nefco 2012

Design: Nimiö(www.nimio.fi)Cover photograph:David Frazier / CorbisPrinthouse:Lönnberg Print Oy,Helsinki 2013This NEFCOpublication hasbeen printed on FSCcertified paper.

39

NOrdiC ENvirONMENtFiNaNCE COrpOratiONStreet address: Fabianinkatu 34Postal address: P. O. Box 249FI-00171 Helsinki, Finlandtel: +358 10 618 003fax: +358 9 630 976www.nefco.org / [email protected]twitter.com/NefcoNordic